As I continue to check for arugments for/against carbon tax (and they are mostly for), I’ve ended up studying overall what good tax design should look like as if someone designed it now.

Lots of work was done on this all the way back in 2011, summed up in the Mirrlees review. I find it disappointing but unsurprising that most recommendations haven’t been taken up. Still here are the top 7 conclusions and more evidence in support of a wide carbon tax at source. See here for more on carbon tax:

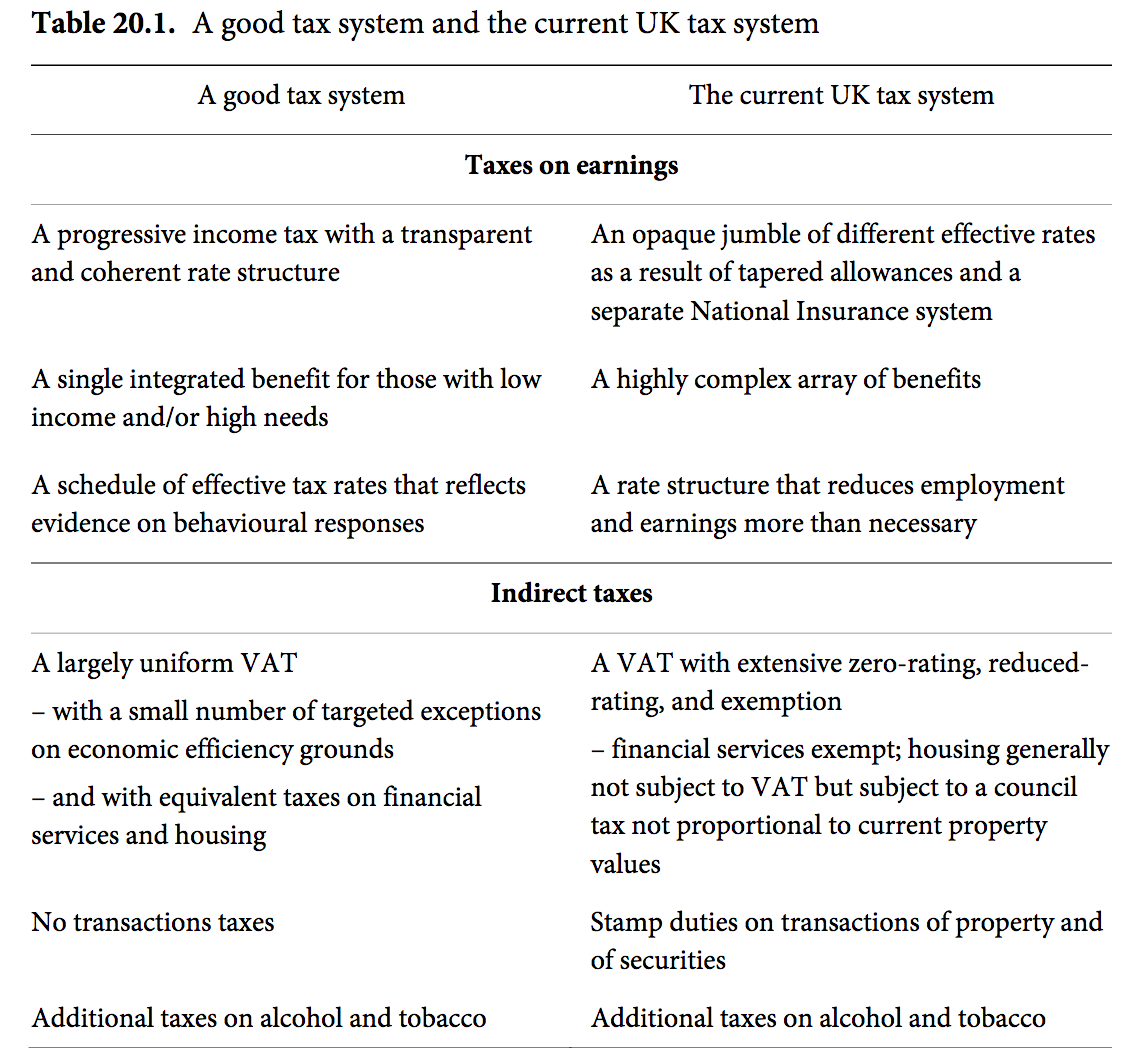

"Against the criteria set out in our vision, the seven major flaws in the UK tax system are:

1. Despite improvements for some groups in recent years, the current system of income taxes and welfare benefits creates serious disincentives to work for many with relatively low potential earning power. The benefit system in particular is far too complex.

2. Many unnecessary complexities and inconsistencies are created by the fact that the various parts of the tax system are poorly joined up. These range from a lack of integration between income taxes and National Insurance contributions (NICs) to a lack of coherence between personal and corporate taxes.

3.The present treatment of savings and wealth transfers is inconsistent and inequitable. There is no consistent tax base identified, saving is discouraged, and different forms of savings are taxed differently.

4. We remain some way short of having a coherent system of environmental taxes to address imperatives around climate change and congestion. The effective tax on carbon varies dramatically according to its source, and fuel duty is a poor substitute for road pricing.

5.The current system of corporate taxes discourages business investment and favours debt finance over equity finance. Its lack of integration with other parts of the tax system also leads to distortions over choice of legal form. Corporate taxes have also been subject to increasing international pressures.

6. Taxation of land and property is inefficient and inequitable. There is a tax on business property—a produced input—but not on land, which is a source of rents. Taxation of housing involves both a transactions tax and a tax based on 20-year-old valuations.

7. Distributional goals are pursued in inefficient and inconsistent ways. For example, zero and reduced rates of VAT help people with particular tastes rather than being targeted at those with low overall resources; and council tax is regressive for no obvious efficiency-improving reasons.”

See here for free downloads - go straight to the conclusions if you don’t want to wade through the evidence!

https://www.thendobetter.com/investing/carbon-tax

https://www.ifs.org.uk/publications/mirrleesreview